https://www.ksl.com/homes/listing/40236358

$489,900, 4681 sq ft, Salem

Kari Dye, Utah Realtor

Buying or selling a home can feel like a monumental endeavor. Kari Dye, Utah REALTOR has 16 years of experience and provides buyers and sellers with excellent customer service, honest professional advice and the highest ethical standards in the industry. Call her at 801-376-8404 or email her at karidyerealtor@outlook.com and check out her website at www.karidyerealtor.com!

.

Wednesday, April 18, 2018

Wednesday, March 22, 2017

4 Great Reasons to Buy This Spring

Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have remained around 4% over the last couple months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison, projecting that rates will increase by at least a half a percentage point this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Wednesday, March 15, 2017

Builder Confidence Hits 11 Year High

In many areas of the country, there are not enough homes for sale to satisfy the number of buyers looking to purchase their dream homes. Experts have long proposed that a ramp-up in new, single-family home construction would be one of the many ways to overcome this inventory shortage.

According to a recent survey conducted by the National Association of Home Builders (NAHB) and Wells Fargo, housing market confidence amongst builders reached an 11-year high last month.

What Does High Confidence Mean for the Housing Market?

In a recent interview, Rob Dietz, Chief Economist and SVP for NAHB, put it this way:

“Higher market confidence will translate into more building and more inventory in 2017. We expect single-family construction to grow 10 percent next year.”

With 2016 marking the best year in real estate sales in over a decade, a 10 percent ramp-up in single-family construction will only aid in making 2017 an even greater year.

According to the latest US Census data, sales of newly constructed homes were up 3.7% over January 2016 as they reached a seasonally adjusted annual rate of 555,000. Dietz went on to comment:

“We can expect further growth in new home sales throughout the year, spurred on by employment gains and a rise in household formations. As the supply of existing homes remains tight, more consumers will turn to new construction.”

Bottom Line

With the weather and the real estate market heating up this spring, there will be a surge of new construction coming to the market soon.

Tuesday, March 7, 2017

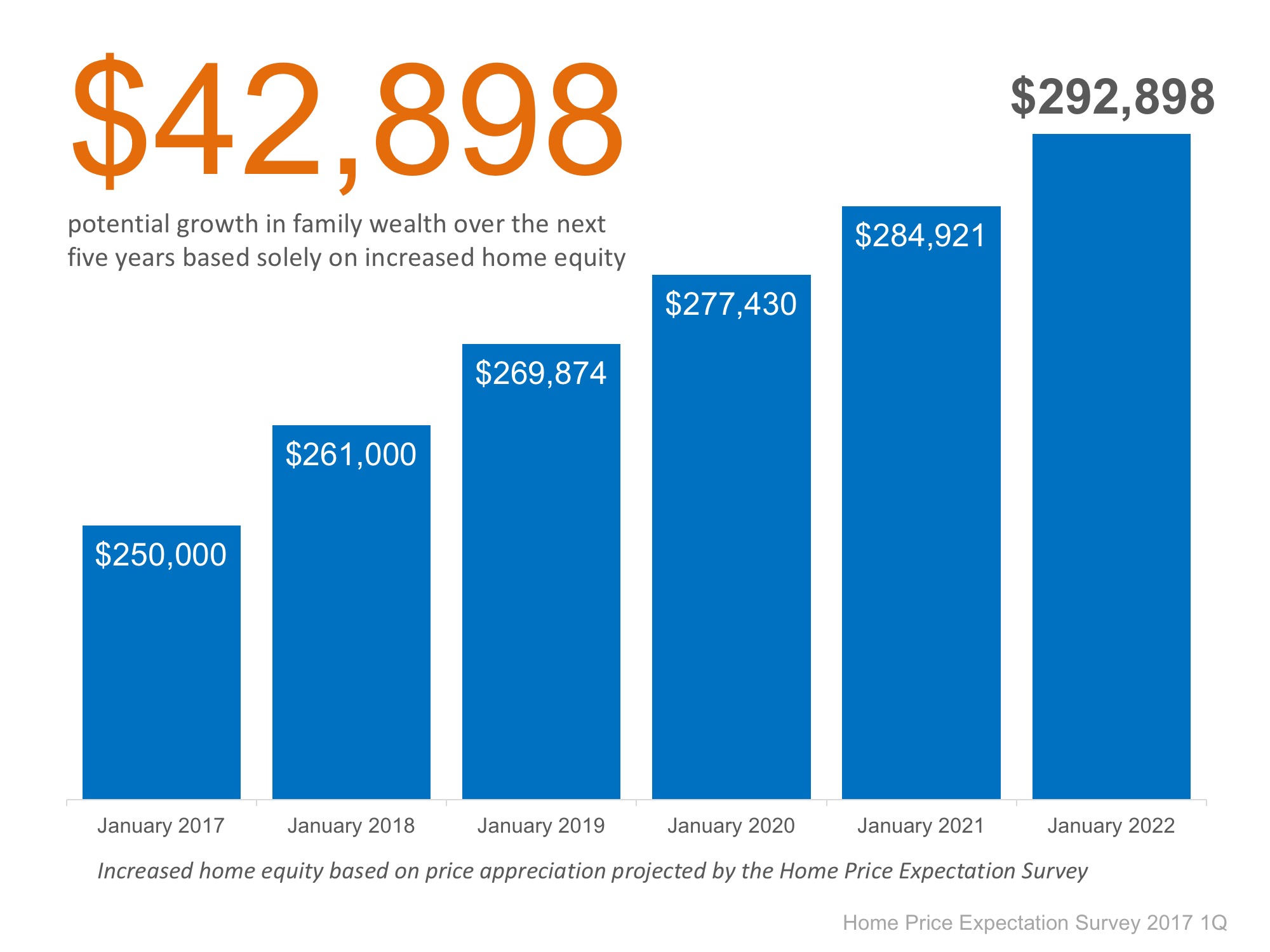

Prices & Family Wealth

Prices & Family Wealth

Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 4.4% this year alone, the young homeowners will have gained $11,000 in equity in just one year.

Over a five-year period, their equity will increase by nearly $43,000! This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a family’s overall net worth.

Bottom Line

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, find out if you are able to today!

Saturday, February 25, 2017

Wednesday, January 11, 2017

Friday, January 6, 2017

Water Damage

If your home is for sale and you have evidence of water damage in the ceiling, even if it's old....fix it NOW! Nothing will scare a buyer more! #hownottostageahome

Wednesday, January 4, 2017

Monday, January 2, 2017

Thursday, December 29, 2016

You Need an Agent Who Will Put You First

You Need an Agent Who Will Put You First

When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal.

One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC’s Modern Family, Phil Dunphy.

For those who aren’t familiar, the character Phil is a Realtor with a huge heart who always strives to do his best for his family and his clients.

In one recent episode, Phil even shared the oath that he created and holds himself accountable to:

"On my honor, I promise to aid in man's quest for shelter, to recognize I'm not just in the business of houses -- I'm in the business of dreams in the shape of houses. To disclose all illegal additions, shoddy construction, murders, and ghosts. And to put my clients' needs before my own."

While this might seem silly, and it was definitely written with humor in mind, the themes of helping someone achieve the American Dream and putting a client's needs above your own are not to be taken lightly.

Bottom Line

When you make the decision to enter the housing market, as either a buyer or a seller, make sure you look for an agent who exemplifies these values and will help you through every step of the process.

Thursday, December 22, 2016

Tuesday, December 20, 2016

Whether You Rent or Own, Either Way You’re Paying a Mortgage

Whether You Rent or Own, Either Way You’re Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

Christina Boyle, Senior Vice President and Head of Single-Family Sales & Relationship Management at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

Bottom Line

This holiday season, why not give yourself the gift of homeownership? Lock in your housing costs for the next 30 years and guarantee you are the one building wealth.

Monday, December 19, 2016

Saturday, December 17, 2016

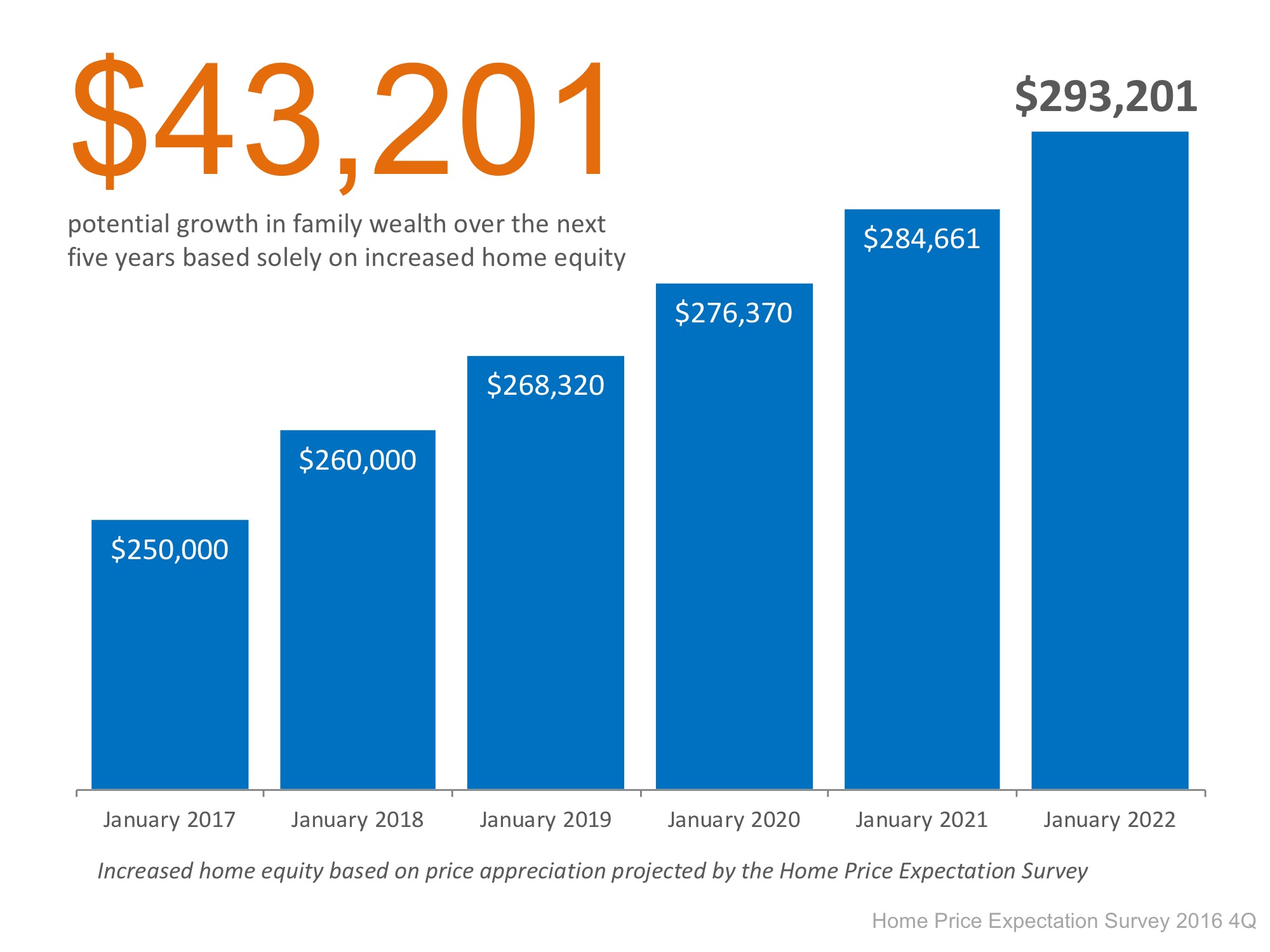

Over the Next Five Years. ..

Over the Next 5 Years

Over the next five years, home prices are expected to appreciate 3.24% per year on average and to grow by 21.4% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, let’s assume a young couple purchases and closes on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 4.0% this year alone, the young homeowners will have gained over $10,000 in equity in just one year.

Over a five-year period, their equity will increase by over $43,000! This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a family’s overall net worth.

Bottom Line

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, let’s get together to find out if you are able to, today!

I Love My Job!

I love working for a company that so willingly gives back! This "Santa" is my Broker and he's helping people in the Lindon Walmart today! #realtorssubforsanta #ilovemyjob

Wednesday, December 14, 2016

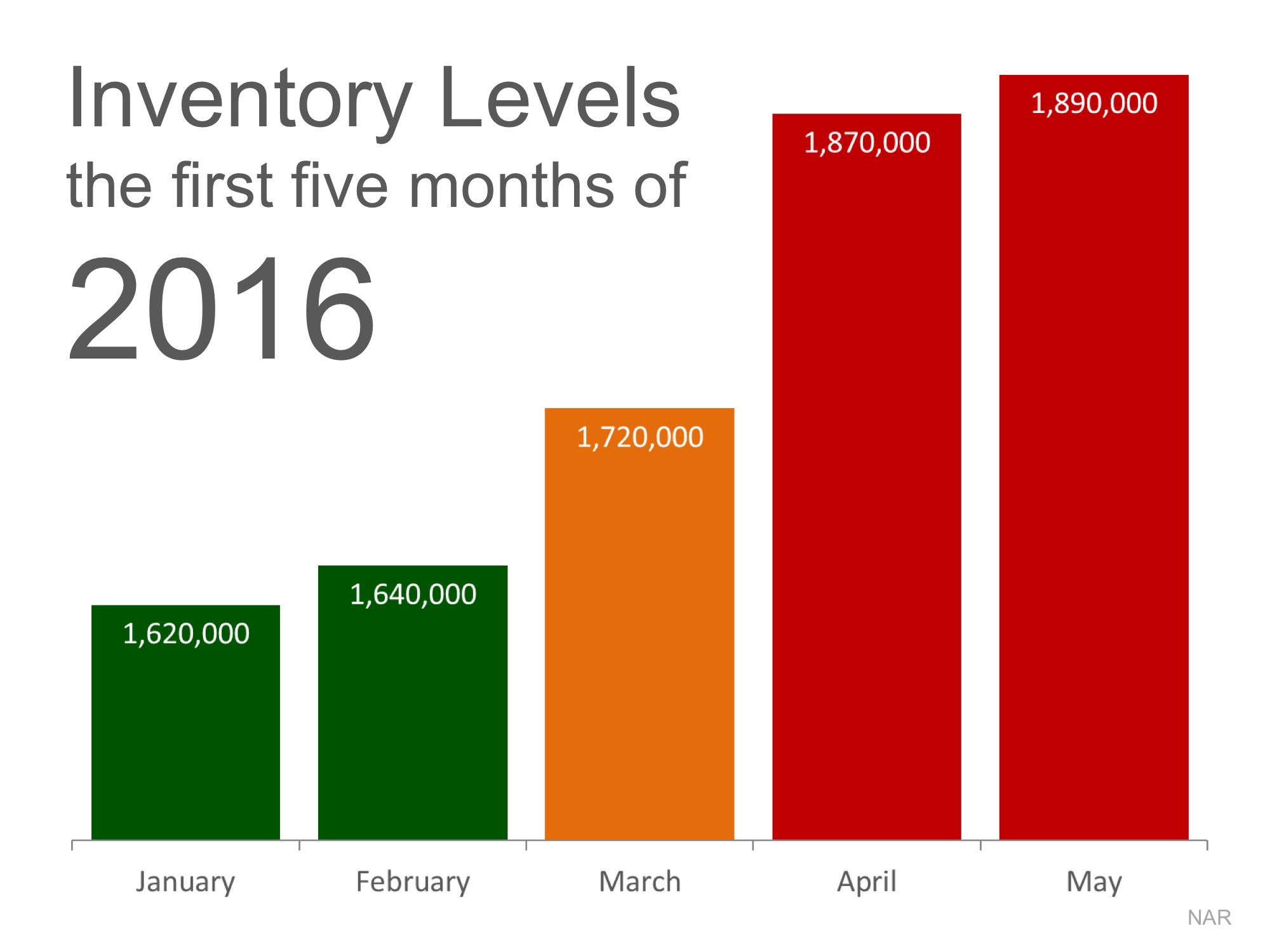

The #1 Reason to Sell Now... Not Next Spring

The #1 Reason to Sell Now… Not Next Spring

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increases every spring. As an example, here is what happened to housing inventory at the beginning of 2016:

Putting your home on the market now instead of waiting for increased competition in the spring might make a lot of sense.

Bottom Line

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

Monday, December 12, 2016

Saturday, December 10, 2016

What the Christmas Season is really all about!

What a beautiful program at the church breakfast today! A great reminder of what the Christmas season is really about!

Wednesday, December 7, 2016

Selling in the Winter Attracts Serious Buyers

Selling in the Winter Attracts Serious Buyers

A recent study of more than 7 million home sales over the past four years revealed that the season in which a home is listed may be able to shed some light on the likelihood that the home will sell for more than asking price, as well as how quickly the sale will close.

It’s no surprise that listing a home for sale during the spring saw the largest return, as the spring is traditionally the busiest month for real estate. What is surprising, though, is that listing during the winter came in second!

“Among spring listings, 18.7 percent of homes fetched above asking, with winter listings not far behind at 17.5 percent. While 48.0 percent of homes listed in spring sold within 30 days, 46.2 percent of homes in winter did the same.”

The study goes on to say that:

“Buyers [in the winter] often need to move, so they’re much less likely to make a lowball offer and they’ll often want to close quickly — two things that can make the sale much smoother.”

Bottom Line

If you are debating listing your home for sale within the next 6 months, keep in mind that the spring is when most other homeowners will decide to list their homes as well. Listing your home this winter will ensure that you have the best exposure to the serious buyers who are out looking now!

The study used the astronomical seasons to determine which season the listing date fell into (Winter: Dec. 21 – Mar. 20; Spring: Mar. 21 – June 20; Summer: June 21 – Sept 21; Autumn: Sept 21 – Dec. 20).

Monday, December 5, 2016

4 Reasons to Buy Your Dream Home This Winter

4 Reasons to Buy Your Dream Home This Winter

As the temperature in many areas of the country starts to cool down, you might think that the housing market will do the same. This couldn’t be further from the truth! Here are 4 reasons you should consider buying your dream home this winter instead of waiting for spring!

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.3% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 5.2% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates are Projected to Increase

Your monthly housing cost is as much related to the price you pay for your home as it is to the mortgage interest rate you secure.

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage are currently at 4.08%. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison, projecting that rates will increase by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way You’re Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide whether it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings

Thursday, December 1, 2016

5 Reasons Why Homeownership is a Good Financial Investment

5 Reasons Why Homeownership Is a Good Financial Investment

According to a recent report by Trulia, “buying is cheaper than renting in 100 of the largest metro areas by an average of 37.7%.” That may have some thinking about buying a home instead of signing another lease extension. But, does that make sense from a financial perspective?

In the report, Ralph McLaughlin, Trulia’s Chief Economist explains:

“Owning a home is one of the most common ways households build long-term wealth, as it acts like a forced savings account. Instead of paying your landlord, you can pay yourself in the long run through paying down a mortgage on a house.”

The report listed five reasons why owning a home makes financial sense:

- Mortgage payments can be fixed while rents go up.

- Equity in your home can be a financial resource later.

- You can build wealth without paying capital gains.

- A mortgage can act as a forced savings account.

- Overall, homeowners can enjoy greater wealth growth than renters.

Bottom Line

Before you sign another lease, let’s get together and discuss all your options.

Subscribe to:

Comments (Atom)